Strategic Analysis of Product Information Management (PIM) Systems for Mid-Market Manufacturing: 2026 Market Report

1. The Manufacturing Data Imperative Going in to 2026

1.1 The Erosion of the ERP-Centric Model

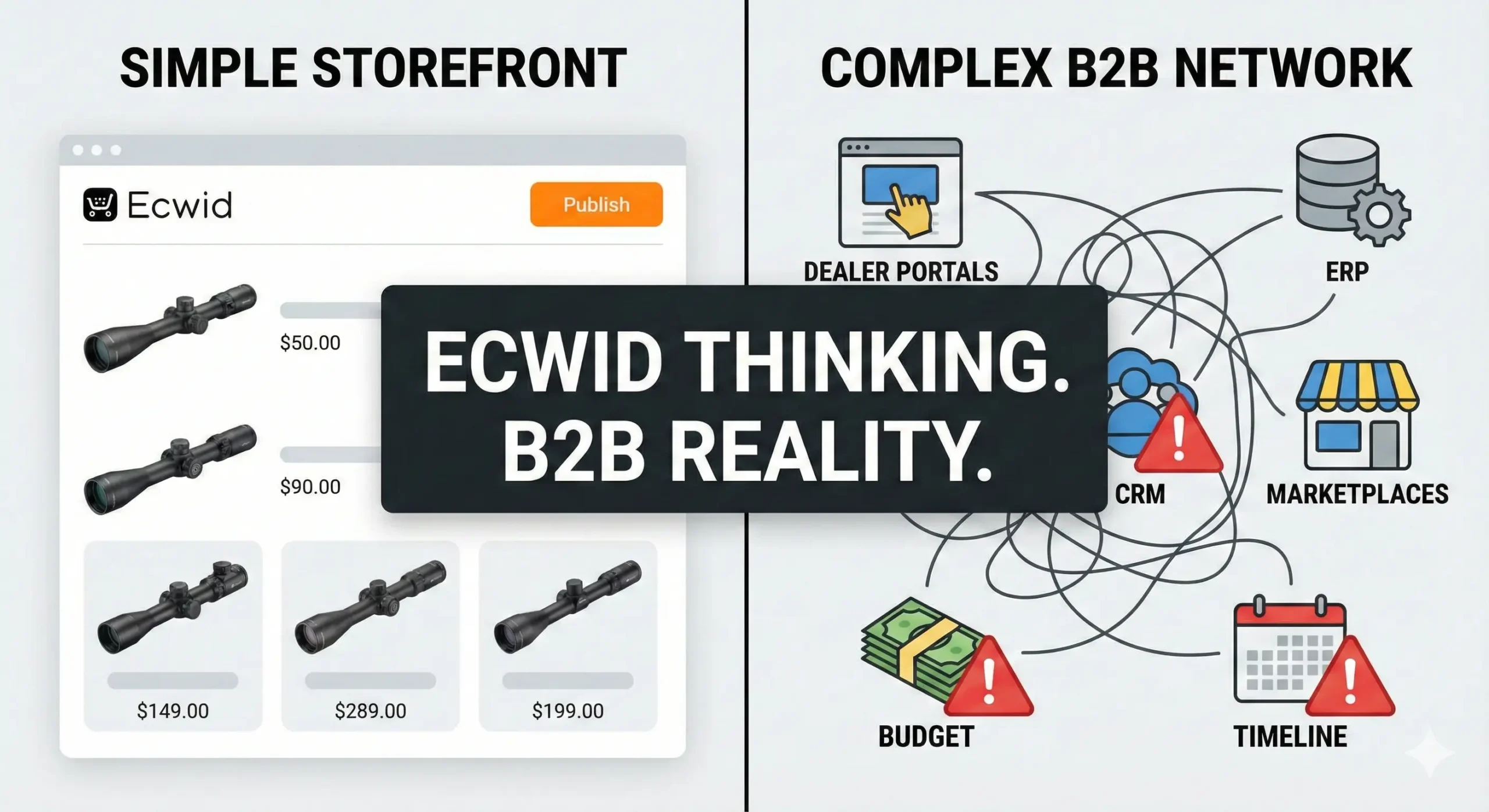

For decades, the manufacturing sector operated under a monolithic data paradigm where the Enterprise Resource Planning (ERP) system served as the singular “source of truth.” In the mid-market sector—defined here as organizations with revenues between $50 million and $1 billion—this reliance on ERPs for product data has become a strategic liability. The analysis of current market trends indicates a fundamental fracture in this model. ERPs, architected for transactional rigidity to safeguard financial and inventory accuracy, are fundamentally ill-equipped to handle the fluid, descriptive, and media-rich requirements of modern digital commerce.1

The modern manufacturer is no longer just a producer of goods but a broadcaster of information. The rise of the “Digital Shelf”—encompassing direct-to-consumer (D2C) websites, B2B portals, and industrial marketplaces like Grainger and Amazon Business—demands a velocity of content that legacy systems cannot support. Where an ERP field might store a cryptic 40-character description like “VLV-BALL-3/4-SS,” the digital channel requires a 500-word marketing description, five high-resolution images, a 3D CAD rendering, a downloadable PDF installation manual, and attributes specific to the taxonomy of the distributor.3

This disconnect has birthed the “Content Gap.” Engineering teams operate in Product Lifecycle Management (PLM) systems with high-fidelity technical data, while sales and marketing teams struggle with spreadsheets, trying to translate that technical data into commercial assets. The introduction of Product Information Management (PIM) systems into the mid-market manufacturing stack is not merely an IT upgrade; it is a strategic decoupling. By moving commercial product enrichment out of the ERP, organizations allow marketing agility without risking the integrity of the transactional core.5

1.2 The Specificity of Mid-Market Challenges

Mid-market manufacturers face a “complexity paradox.” They often possess product catalogs as complex as Global 2000 enterprises—featuring multi-level Bills of Materials (BOMs), intricate kitting requirements, and deep regulatory compliance needs—yet they lack the unlimited IT budgets and sprawling development teams of their larger competitors.7

The research highlights three critical pressure points driving PIM adoption in this segment for 2026:

- Supply Chain Transparency and the Digital Product Passport (DPP): Impending EU regulations and global sustainability standards are forcing manufacturers to track and display data regarding material provenance, carbon footprint, and recyclability. This “non-visual” data must be managed alongside marketing copy, a requirement that standard e-commerce PIMs fail to address adequately.1

- Syndication to Industrial Aggregators: Selling through channels like Grainger, Fastenal, and MSC Industrial is no longer a passive activity. These distributors have implemented rigorous data quality standards. “Golden Records” must be mapped to specific taxonomies (e.g., UNSPSC codes) to avoid delisting. Manual entry is mathematically impossible at scale.8

- The Talent Gap: Mid-market firms often operate with lean marketing teams. They require systems that allow a small team of non-technical marketers to manage thousands of SKUs. User Experience (UX) and “No-Code” configurability have transitioned from “nice-to-have” to mission-critical criteria.7

1.3 Scope of Analysis

This report provides an exhaustive, comparative analysis of the five PIM systems best suited to navigate these specific challenges in 2026: Sales Layer, Catsy, inRiver, Akeneo, and Pimcore. These platforms were selected based on a rigorous filter prioritizing B2B manufacturing capabilities, ERP integration readiness, and mid-market Total Cost of Ownership (TCO).

2. Market Landscape and Evaluation Criteria

To accurately rank and analyze these systems, we must establish the specific criteria that define success in the mid-market manufacturing context. Generic PIM reviews often prioritize retail fashion or CPG features (e.g., seasonal collections, social media integration), which are peripheral to industrial needs. Our analysis prioritizes the following:

2.1 Technical and Functional Criteria

- BOM and Kitting Support: The ability to model “Parent-Child” relationships where a finished good is composed of distinct parts, each with its own enriched data. This includes handling “exploded views” for spare parts sales.8

- CAD and Technical Asset Management: Native ability to ingest, preview, and associate technical drawings (DWG, DXF) and manage version control on PDF spec sheets, distinct from marketing imagery.5

- Print Catalog Automation: Despite digitization, the printed spec sheet and catalog remain vital in B2B field sales. The ability to dynamically generate high-resolution PDFs from PIM data is a high-value capability.13

- Industrial Syndication: Pre-built templates for industrial distributors (Grainger, Wayfair, Amazon Business) to minimize the “time-to-listing”.8

- ERP Connectivity: The availability of “low-code” or native connectors for mid-market ERPs such as Microsoft Dynamics 365, Oracle NetSuite, and SAP Business One.8

2.2 Commercial and Operational Criteria

- Time-to-Value: Mid-market firms rarely have the appetite for 12-month implementations. We evaluate the realistic deployment timelines, prioritizing solutions that can go live in under 4 months.16

- Total Cost of Ownership (TCO): Analysis of licensing models (SaaS vs. Open Source), hosting costs, and hidden implementation fees. The target range is accessible operational expenditure (OpEx) rather than massive capital expenditure (CapEx).18

- Ease of Use: The “Marketer-Friendliness” of the interface. Can a product manager update a spec sheet without calling IT?.16

3. Deep Dive Analysis: Sales Layer

3.1 Strategic Positioning: The Agile Marketing Enabler

Sales Layer has carved out a dominant position in the mid-market by focusing relentlessly on agility and user experience (UX). In a market often cluttered with technically dense software requiring extensive training, Sales Layer positions itself as the “Anti-IT” PIM—sophisticated enough for complex data but intuitive enough for marketing interns to master in days.10

For manufacturers transitioning from chaotic spreadsheets to their first centralized system, Sales Layer offers the lowest barrier to entry. Its philosophy centers on “Marketing Autonomy,” aiming to remove the dependency on technical teams for day-to-day data operations.

3.2 Architectural Strengths for Manufacturing

While often perceived as a “lighter” tool, Sales Layer’s architecture supports surprisingly deep complexity suitable for industrial needs.

3.2.1 Quality Analysis and Data Health

One of Sales Layer’s most compelling features for manufacturers is its integrated Quality Score algorithm. Manufacturing data is notoriously “dirty”—filled with inconsistent abbreviations, missing tolerances, and duplicate entries inherited from legacy ERPs. Sales Layer analyzes the dataset and assigns a health score to each product and category.

- Mechanism: It identifies gaps (e.g., “Missing Safety Data Sheet URL”) and guides the user to fix them before the data can be syndicated.

- Insight: This proactive governance prevents the common issue of “garbage in, garbage out” syndication, where distributors reject bulk uploads due to missing mandatory fields. It turns data governance from a policing action into a gamified improvement process.19

3.2.2 The Instant Catalog and Print Automation

Sales Layer recognizes that B2B sales often require offline documentation. Its Instant Catalog feature allows users to select a subset of products and generate a branded, high-resolution PDF catalog or datasheet on the fly.

- Implication: This replaces the manual workflow where engineers or marketers use Adobe InDesign to update spec sheets one by one. By automating this from the PIM, manufacturers ensure that the PDF downloaded by a field technician always matches the specs on the website, reducing liability risks associated with outdated technical data.13

3.3 Integration and Ecosystem

Sales Layer provides a library of connectors that target the “Modern Mid-Market Stack.”

- ERP: Native connectors for Microsoft Dynamics 365, NetSuite, and SAP Business One. These connectors often utilize API-based synchronization to pull core SKU data (stock, price, SKU) from the ERP while pushing enriched descriptions back if necessary.15

- eCommerce: Strong integration with BigCommerce and Shopify, which are increasingly the platforms of choice for mid-market B2B portals.16

- Syndication: The platform includes built-in connectors for Amazon (via API) and Google Manufacturer Center. For specialized industrial channels, it allows for easy CSV mapping configuration, though it may lack the dedicated “pre-validation” logic for Grainger found in more specialized tools like Catsy.3

3.4 Economic Analysis: Pricing and TCO

Sales Layer utilizes a pure SaaS subscription model with three primary tiers: Scale, Premium, and Enterprise.

- Cost Structure: This model provides high predictability. There are no “server maintenance” fees or upgrade costs associated with on-premise software.

- Implementation: Sales Layer boasts an average implementation time of 6 weeks. This rapid deployment significantly lowers the TCO compared to platforms requiring 6-month integration projects. The “Scale” plan is accessible for smaller manufacturers, while “Enterprise” unlocks workflows and advanced permissions.16

3.5 Critical Limitations

While excellent for agility, Sales Layer has ceilings.

- Customization: It is a closed SaaS environment. Highly complex, non-standard business logic that requires modifying the core code is not possible.

- Deep BOM Management: While it handles variants and groups well, true multi-level BOM explosion and “kitting” logic is less sophisticated than in Pimcore or Catsy.21

4. Deep Dive Analysis: Catsy

4.1 Strategic Positioning: The B2B Industrial Specialist

Catsy stands apart as the only PIM in this analysis that explicitly identifies as a “B2B Industrial” solution. It is not a generalist tool adapted for manufacturing; it is purpose-built for the sector. Its entire workflow, terminology, and feature set are designed around the needs of industrial brands, heavy equipment manufacturers, and wholesale distributors.8

Catsy addresses the specific intersection of PIM, DAM, and Lead Management, recognizing that in B2B manufacturing, a product page is often a lead generation tool for a complex sale, not just a “Add to Cart” button.

4.2 Architectural Strengths for Manufacturing

Catsy’s architecture is “Spec-First,” prioritizing technical accuracy and specification management over marketing fluff.

4.2.1 Native BOM and Kitting Management

Catsy provides superior handling of Bills of Materials (BOMs). Unlike retail PIMs that flatten products into simple lists, Catsy allows for the preservation of hierarchical structures.

- Mechanism: Users can link a finished good (e.g., an industrial drill) to its replacement motor, drill bits, and safety guard within the PIM.

- Insight: This capability is crucial for “Aftermarket Sales.” By maintaining these links, manufacturers can automatically populate “Spare Parts” and “Accessories” tabs on their B2B portals, directly driving high-margin revenue from existing install bases.23

4.2.2 The “Distributor-Ready” Syndication Engine

Catsy’s strongest differentiator is its pre-configured templates for industrial distributors.

- Grainger & Fastenal: Catsy includes built-in templates that mirror the rigorous data intake requirements of Grainger, Fastenal, MSC Industrial, and Ferguson.

- Pre-Flight Validation: The system validates data against these distributor standards before export. If Grainger requires a specific UNSPSC code or a boolean value for “Hazardous Material,” Catsy flags errors immediately. This drastically reduces the “rejection loop” where products sit in distributor limbo for weeks due to data errors.8

4.2.3 Integrated CAD and Spec Sheet Management

Catsy treats PDF spec sheets and CAD drawings as first-class citizens. Its built-in DAM allows for the storage of technical files linked to specific SKUs. Furthermore, its ability to automate the creation of branded spec sheets ensures that sales teams can generate up-to-date collateral on demand, solving the perennial issue of sales reps using outdated PDFs stored on their desktops.24

4.3 Integration and Ecosystem

Catsy focuses its integration efforts on the systems most common in North American manufacturing.

- ERP: It offers robust connectors for NetSuite, Oracle, Sage, and Epicor. The integration depth typically includes inventory level syncing to ensure spec sheets reflect availability.8

- Partnerships: Catsy has cultivated specific partnerships within the industrial supply chain ecosystem, positioning itself as a “middleware” that understands the language of industrial supply.18

4.4 Economic Analysis: Pricing and TCO

Catsy targets the mid-market with a competitive SaaS model.

- Value Proposition: The ROI for Catsy is often calculated based on “Syndication Efficiency.” By eliminating the manual labor required to format spreadsheets for Grainger or Amazon, the system pays for itself in labor savings.

- Implementation: Implementation is typically fast (8-12 weeks) because the templates for distributors are pre-built. There is less “custom modeling” required compared to a blank-slate PIM.18

4.5 Critical Limitations

- Niche Focus: Catsy is hyper-focused. A manufacturer that also has a fashion or lifestyle division might find Catsy’s industrial-centric interface limiting for “emotional” merchandising.

- Ecosystem Size: Compared to Akeneo, Catsy has a smaller marketplace of third-party plugins, relying more on its core built-in features.25

5. Deep Dive Analysis: inRiver

5.1 Strategic Positioning: The Product Journey and Merchandising Engine

inRiver occupies the premium end of the mid-market, bridging the gap to enterprise solutions. Its strategic philosophy is built around the “Product Journey”—the idea that product data is not static storage but a fluid asset that moves through stages of creation, enrichment, planning, and publishing.

inRiver is particularly strong for manufacturers who have high-volume merchandising needs or who are shifting aggressively to a Direct-to-Consumer (D2C) model. It excels in “Product Experience Management” (PXM), helping brands tell a consistent story across global channels.26

5.2 Architectural Strengths for Manufacturing

inRiver’s technical differentiator is its Elastic Data Model.

5.2.1 The Elastic Data Model

Most PIMs use a rigid table structure (Products, Variants, Attributes). inRiver uses a graph-like structure of “Entities” and “Links.”

- Mechanism: In inRiver, a “Product,” “Spare Part,” “Bundle,” “Task,” or even “Channel” are all entities that can be linked freely. A manufacturer can link a “Repair Kit” entity to 50 different “Tool” entities without creating duplicate data records.

- Insight: This flexibility is vital for complex merchandising. It allows manufacturers to create “virtual bundles” for specific seasons or channels (e.g., a “Holiday Tool Kit” for Amazon) without altering the core ERP data structure. It decouples the merchandising structure from the manufacturing structure.28

5.2.2 Syndicate Plus and Digital Shelf Analytics

inRiver has heavily invested in what happens after the data leaves the PIM.

- Syndicate Plus: This module allows for granular control over how data appears on third-party sites. It includes specific API connections to major retailers and industrial sites.

- Digital Shelf Analytics (DSA): Uniquely, inRiver includes technology to “scrape” and monitor the manufacturer’s products on external sites. It can alert the manufacturer if a distributor has listed the wrong price, if the product is out of stock, or if the images are broken. This “closed-loop” feedback is a massive strategic advantage for brand protection.26

5.2.3 Print Module

inRiver possesses one of the strongest print modules in the industry (inRiver Print). It integrates deeply with Adobe InDesign, allowing for the semi-automated production of massive industrial catalogs (often 500+ pages). For manufacturers who still rely on the “Big Book” annual catalog, this feature alone can justify the investment.29

5.3 Integration and Ecosystem

inRiver is a Microsoft Gold Partner and has exceptionally strong ties to the Microsoft ecosystem.

- ERP: It is often the default choice for shops running Microsoft Dynamics 365. The integration is mature and well-supported.30

- Sustainability: inRiver is aggressive on the ESG front, building specific data structures to support the Digital Product Passport, tracking carbon footprint data at the entity level.9

5.4 Economic Analysis: Pricing and TCO

inRiver is the most expensive option in this specific mid-market analysis.

- Cost Structure: It is a premium SaaS solution. Licensing fees are typically in the tens of thousands annually, and implementation almost always requires a certified partner (like Ntara or Absolunet), adding service costs.

- Time-to-Value: Implementations are longer (3-6 months) due to the complexity of the data modeling workshops required to leverage the elastic model effectively.31

5.5 Critical Limitations

- Complexity: The elastic model is powerful but has a steep learning curve. It requires a dedicated “PIM Administrator” who understands data architecture. It is not a “set it and forget it” tool.

- Cost: It may be overkill for a manufacturer with a simple product line or limited budget.32

6. Deep Dive Analysis: Akeneo

6.1 Strategic Positioning: The Product Experience (PXM) Ecosystem

Akeneo has successfully branded itself as the leader in “Product Experience Management” (PXM). Its focus is on the emotional and experiential aspect of product data—turning specs into stories. Akeneo operates a dual model: a free, open-source Community Edition and a paid SaaS Enterprise Edition. For mid-market manufacturers, the Enterprise Edition is the realistic choice due to required features like the Asset Manager and advanced permissions.33

Akeneo is the “Marketer’s Choice” for organizations that prioritize global expansion, localization, and omni-channel consistency.

6.2 Architectural Strengths for Manufacturing

Akeneo’s architecture is modern, API-first, and highly extensible.

6.2.1 The “Frankline” Interface and Gamification

Akeneo tackles the human problem of data entry boredom. Its interface, known as “Frankline,” uses gamification to drive data completeness.

- Mechanism: It tracks the “Completeness” of every product per channel (e.g., “Amazon: 80% complete,” “Mobile App: 100% complete”). Visual progress bars motivate teams to fill in missing attributes.

- Insight: For manufacturers with thousands of SKUs, data fatigue is real. Akeneo’s UX significantly improves user adoption and data velocity compared to drab, ERP-like interfaces of legacy PIMs.35

6.2.2 Asset Manager and Localization

The Enterprise Edition includes a robust Asset Manager that can automatically resize and format images for different channels (e.g., creating a thumbnail for the web and a high-res TIFF for print from a single master file). Furthermore, its localization engine is best-in-class, allowing manufacturers to manage translations for global markets with sophisticated workflows.33

6.2.3 Shared Catalogs

Akeneo’s Shared Catalogs feature allows manufacturers to create secure, branded portals for their distributors. Instead of emailing an Excel sheet to a dealer, the manufacturer sends a link to a curated portal where the dealer can download the assets and data they need. This acts as a “lightweight B2B portal”.37

6.3 Integration and Ecosystem

Akeneo’s greatest strength is its ecosystem. It has the largest marketplace of connectors in the PIM world.

- B2B Connectors: If a manufacturer uses a niche ERP or a specific translation agency, there is likely already an Akeneo plugin for it.

- Print: Akeneo partners with Priint, a leading publishing automation tool. While print isn’t native to Akeneo core (like in inRiver), the Priint integration is seamless and powerful for generating catalogs.38

- Syndication: Akeneo acquired a syndication tool (now Akeneo Activation), allowing it to compete directly with Sales Layer and feed data to Amazon and other retailers natively.39

6.4 Economic Analysis: Pricing and TCO

- Licensing: Akeneo Enterprise is mid-to-high priced SaaS. The Community Edition is free but requires hosting, maintenance, and likely paid extensions, often resulting in a higher TCO than expected.

- Implementation: The extensive partner network means competitive pricing for integration services. Implementation timelines are typically 3-5 months.17

6.5 Critical Limitations

- BOM Management: Akeneo handles simple variants (Color/Size) well, but complex industrial BOMs (multi-level, nested components) are not its native strength. They often require “Reference Entities” or workarounds that can be cumbersome compared to Catsy or Pimcore.33

7. Deep Dive Analysis: Pimcore

7.1 Strategic Positioning: The IT & Data Sovereign’s Platform

Pimcore is fundamentally different from the other four. It is not just a PIM; it is a Platform that combines PIM, MDM (Master Data Management), DAM, CDP (Customer Data Platform), and DXP (Digital Experience Platform). It is the “Swiss Army Knife” of data management.

Pimcore is the preferred choice for IT-led organizations that want complete control over their data architecture and are willing to invest in development to get a perfectly tailored solution.40

7.2 Architectural Strengths for Manufacturing

Pimcore’s architecture is its superpower: it is a Data Management Framework.

7.2.1 Unlimited Data Modeling

Pimcore allows for the creation of any data entity.

- Mechanism: A manufacturer can model “Products,” but also “Factories,” “Suppliers,” “Trucks,” “Projects,” or “Certifications” as distinct entities with their own attributes and relationships.

- Insight: For complex manufacturing groups (perhaps growing through acquisition), Pimcore can act as a Master Data Manager, consolidating data from 5 different ERPs, cleaning it, and acting as the central hub for the entire enterprise. It offers the most robust modeling for complex BOMs and intricate product logic.11

7.2.2 Integrated DAM and MDM

The DAM in Pimcore is enterprise-grade, capable of handling 200+ file types including complex CAD and video formats. It supports automated transcoding and metadata tagging. Because the PIM and DAM are one database, the linkage between a product and its image is unbreakable and instant.12

7.2.3 Open Source Flexibility

Being open-source (PHP/Symfony), Pimcore allows manufacturers to own the code. They can build custom portals, custom workflows, or custom API endpoints without vendor restrictions. This eliminates “vendor lock-in” on the feature set.33

7.3 Integration and Ecosystem

- Connectivity: Pimcore uses an “API-driven” approach. It connects to anything, but often requires configuration. It excels in complex ERP integrations (SAP, Oracle) where data transformation is required inside the PIM.43

- Output: Its “Web-to-Print” framework is highly customizable, allowing for the programmatic generation of complex catalogs.44

7.4 Economic Analysis: Pricing and TCO

Pimcore presents a unique economic model.

- Licensing: The Community Edition is free (zero license cost). The Enterprise Subscription adds SLA, LTS (Long Term Support), and portal features.

- TCO Warning: While the license is cheap, the implementation and maintenance costs are high. Using Pimcore requires access to PHP developers (internal or agency). The TCO is shifted from OpEx (Subscription) to CapEx (Development) and ongoing maintenance.32

7.5 Critical Limitations

- Usability: Out of the box, Pimcore’s interface is technical. It looks like a database admin tool. It requires customization to make it “marketer-friendly.”

- Complexity: It is overkill for simple needs. Implementing Pimcore for a basic catalog is like using a Ferrari to deliver mail.46

8. Comparative Data Analysis

The following tables synthesize the qualitative data into direct comparisons to facilitate decision-making.

8.1 Functional Capability Matrix

| Capability | Sales Layer | Catsy | inRiver | Akeneo | Pimcore |

| Primary User Persona | Marketer / SMB | Industrial Mgr | Merchandiser | Brand Mgr | IT Architect |

| BOM / Kitting Support | Basic (Groups) | Strong (Graph) | Native / Dedicated | Via Workarounds | Unlimited / Custom |

| Industrial Syndication | Configurable | Native (Grainger) | Syndicate Plus | Activation Module | Custom Export |

| Print / PDF Gen | Instant Catalog | Spec Sheet Gen | Print Module (InDesign) | Partner (Priint) | Web-to-Print |

| Data Governance | Quality Score | Validated Templates | Rules Engine | Completeness | MDM Class |

| ERP Integration | API Connectors | Enterprise Integration | Mfg ERP Focused | Marketplace | API / Middleware |

Table 1: Functional Comparison based on Manufacturing Requirements 3

8.2 Total Cost of Ownership (TCO) & Implementation Model

| Metric | Sales Layer | Catsy | inRiver | Akeneo | Pimcore |

| License Model | SaaS (Tiered) | SaaS (Tiered) | SaaS (Premium) | SaaS / Open Source | Open Source / Sub |

| Implementation Time | 6 – 8 Weeks | 8 – 12 Weeks | 3 – 6 Months | 3 – 5 Months | 6+ Months |

| Implementation Cost | Low (Config) | Low/Mid (Config) | High (Consulting) | Mid (Partner) | High (Development) |

| Maintenance Load | Minimal | Minimal | Moderate (Admin) | Moderate | High (Dev/Updates) |

| Ideal Revenue Tier | $20M – $200M | $50M – $500M | $100M – $1B+ | $50M – $1B+ | $50M – $1B+ |

Table 2: Economic Model Comparison 16

9. Implementation Strategic Guide

Selecting the software is only the first step. The success of a PIM project in manufacturing relies heavily on the implementation strategy.

9.1 The “Data First” Approach

A common failure mode is attempting to migrate data during the implementation. Successful manufacturers perform a “Data Audit” before signing the contract.

- Recommendation: Aggregation of all spreadsheets, CAD exports, and ERP dumps into a single location to assess the “mess.” Tools like Sales Layer’s Quality Score can be used in a trial phase to audit this data.19

9.2 The Team Structure

For the mid-market, the “PIM Team” should not be solely IT-led.

- Project Sponsor: VP of Sales or Operations (Business Stakeholder).

- PIM Administrator: A “Product Data Manager” (Marketing function).

- Technical Lead: IT resource for ERP connectivity.

- Subject Matter Experts: Engineers who verify the technical accuracy of the specs.

9.3 Phased Rollout

Avoid the “Big Bang” launch.

- Phase 1: Centralization. Get all data into the PIM.

- Phase 2: Enrichment. Improve descriptions and add assets.

- Phase 3: Syndication. Turn on the feed to the website/Shopify.

- Phase 4: Advanced Syndication. Turn on Grainger/Amazon feeds.

- Phase 5: Print Automation.

10. Future Outlook: AI, DPP, and The Intelligent Supply Chain

The PIM landscape of 2026 is being reshaped by three macro-trends that mid-market manufacturers must anticipate.

10.1 Artificial Intelligence (Generative Enrichment)

AI is moving from “hype” to “utility” within these platforms.

- Sales Layer & Akeneo are integrating Generative AI (ChatGPT/LLMs) to automatically rewrite technical ERP descriptions into persuasive marketing copy. For a manufacturer with 10,000 SKUs, this reduces copywriting labor by 90%.19

- Translation: AI is enabling instant localization, allowing US manufacturers to launch in Mexico or Canada with localized catalogs at a fraction of the traditional translation cost.

10.2 The Digital Product Passport (DPP)

The EU’s Digital Product Passport initiative will essentially require a “Digital Twin” for products, containing data on materials, repairability, and carbon footprint.

- Implication: PIMs are becoming the repository for this compliance data. inRiver and Pimcore are leading the charge here, creating specific data structures to house DPP information. Manufacturers selling into Europe must prioritize PIMs with these capabilities.1

10.3 The Convergence of PIM and Service

We are seeing a trend where PIM data powers “Self-Service Portals.”

- Trend: Manufacturers are exposing their PIM data via APIs to Chatbots and Service Portals. A technician in the field can scan a QR code on a machine, and the PIM serves up the exact schematic and spare parts list for that specific serial number. Catsy and Pimcore are particularly well-suited for this “Service-PIM” convergence due to their handling of technical docs and relationships.13

11. Final Recommendations

Based on the synthesis of feature sets, economic models, and strategic fit, we offer the following targeted recommendations for mid-market manufacturers:

- Select Sales Layer if: You are a marketing-driven organization needing to modernize quickly. You have limited IT resources and your primary pain point is “spreadsheet chaos.” You need a tool that is easy to adopt and provides quick wins on the digital shelf.

- Select Catsy if: You are a hardcore industrial manufacturer or distributor. Your revenue depends on Grainger, Fastenal, and B2B portals. You need deep BOM management and automated spec sheets without custom development.

- Select inRiver if: You are a merchandising-focused brand with a complex product lifecycle. You are moving into D2C and need to manage the “story” of the product across global markets. You have the budget for a premium, strategic platform.

- Select Akeneo if: You value the “Product Experience” and need a platform with a massive ecosystem of connectors to fit a complex, best-of-breed tech stack (e.g., Salesforce, Adobe, Magento).

- Select Pimcore if: You have a strong internal IT/Dev team and complex data requirements that go beyond simple products (e.g., managing projects, suppliers, and assets in one web of data). You want to build a custom data platform, not just buy a tool.

In the 2026 landscape, the PIM is no longer optional for the mid-market manufacturer. It is the operational engine that translates engineering innovation into market revenue. The choice of system will dictate the speed and agility with which the manufacturer can compete in an increasingly digital industrial economy.

Works cited

- 10 Best Product Information Management (PIM) Systems in 2025, accessed December 24, 2025, https://kontainer.com/news/10-best-pim-systems-in-2025

- How To Use PIM Integration To Advance Your ERP System – DynamicWeb, accessed December 24, 2025, https://dynamicweb.com/resources/insights/blog/how-to-use-pim-integration-to-advance-your-erp-system

- Product Information Management PIM – Sales Layer, accessed December 24, 2025, https://www.saleslayer.com/product-information-management-pim

- Why Industrial Manufacturers Need Dedicated PIM for Product Data Management – Catsy, accessed December 24, 2025, https://catsy.com/blog/erp-pim-for-industrial-manufacturer/

- PIM for Modern Manufacturers: Enhance Efficiency and Product Accuracy – Catsy, accessed December 24, 2025, https://catsy.com/blog/pim-for-modern-manufacturers/

- PIM vs ERP integrations in the Product Ecosystem – Akeneo, accessed December 24, 2025, https://www.akeneo.com/blog/pim-vs-erp-in-the-product-ecosystem/

- Best Product Information Management Software: Top 10 PIM Providers – Dragonfly AI, accessed December 24, 2025, https://dragonflyai.co/resources/blog/best-product-information-management-software-top-10-pim-providers

- PIM for Manufacturers | BOM Management, ERP Integration & Technical Data – Catsy, accessed December 24, 2025, https://catsy.com/pim-for-manufacturers

- The new role of PIM in SAP-driven organizations – Inriver, accessed December 24, 2025, https://www.inriver.com/resources/pim-role-sap-driven-organizations/

- Sales Layer 2025 Pricing, Features, Reviews & Alternatives – GetApp, accessed December 24, 2025, https://www.getapp.com/project-management-planning-software/a/sales-layer/

- BoM in PIM and ERP – PIMvendors, accessed December 24, 2025, https://pimvendors.com/pim/bill-of-materials-in-pim-and-erp/

- Pimcore for Manufacturing: Transforming Product Data Management in Industrial Environments – Netguru, accessed December 24, 2025, https://www.netguru.com/blog/pimcore-for-manufacturing

- PIM for lighting industry – Sales Layer, accessed December 24, 2025, https://www.saleslayer.com/solutions/pim-for-lighting

- Affiliated Distributors | Inriver Partner Network, accessed December 24, 2025, https://www.inriver.com/partner/affiliated-distributors/

- Integrations Marketplace – Sales Layer, accessed December 24, 2025, https://www.saleslayer.com/features/integrations

- Sales Layer PIM for Marketers, accessed December 24, 2025, https://www.saleslayer.com/pim-for-marketers

- The Top 10 Akeneo Case Studies of 2023, accessed December 24, 2025, https://www.akeneo.com/blog/10-customer-case-studies/

- Example of PIM Software: Real-World Solutions for Product Data Management – Catsy, accessed December 24, 2025, https://catsy.com/blog/example-of-pim-software/

- PIM Pricing – Sales Layer, accessed December 24, 2025, https://www.saleslayer.com/pricing

- PIM for Distributors – Sales Layer, accessed December 24, 2025, https://www.saleslayer.com/pim-for-distributors

- Sales Layer PIM Pros and Cons | User Likes & Dislikes – G2, accessed December 24, 2025, https://www.g2.com/products/sales-layer-pim-2025-04-09/reviews?qs=pros-and-cons

- Catsy | Product Information Management (PIM) System, accessed December 24, 2025, https://catsy.com/

- Multi-Level BOM Management with PIM – Catsy, accessed December 24, 2025, https://catsy.com/blog/multi-level-bom-management/

- The Forrester Wave Methodology, accessed December 24, 2025, https://www.forrester.com/policies/forrester-wave-methodology/

- Compare Catsy DAM & PIM vs. Sales Layer PIM – G2, accessed December 24, 2025, https://www.g2.com/compare/catsy-dam-pim-vs-sales-layer-pim-2025-04-09

- PIM for manufacturing | Inriver, accessed December 24, 2025, https://www.inriver.com/resources/pim-for-manufacturing/

- PIM software for mid-market – Inriver, accessed December 24, 2025, https://www.inriver.com/solution/mid-market/

- Building a business-ready PIM data model & governance framework – Inriver, accessed December 24, 2025, https://www.inriver.com/resources/pim-data-model/

- Inriver Syndicate Advance | Fast-track your Product Syndication Strategy, accessed December 24, 2025, https://www.inriver.com/resources/inriver-syndicate/

- SAP | An Inriver PIM Solutions Partner, accessed December 24, 2025, https://www.inriver.com/partner/sap/

- inRiver vs Plytix – PIM Comparison, accessed December 24, 2025, https://www.plytix.com/pim-comparison/vs-inriver

- Inriver vs Akeneo vs Pimcore: Which PIM powers real business growth?, accessed December 24, 2025, https://www.inriver.com/resources/inriver-vs-akeneo-vs-pimcore/

- Comparing the 10 best PIM platforms, 2025 – Alumio, accessed December 24, 2025, https://www.alumio.com/blog/comparing-10-best-pim-platforms-in-2025

- PIM Integrations for Simplified Product Information Management Across Channels – Akeneo, accessed December 24, 2025, https://www.akeneo.com/blog/pim-integrations/

- B2B Manufacturing – Akeneo, accessed December 24, 2025, https://www.akeneo.com/b2b-manufacturing/

- Twelve Tales of PXmas: Stories of Product Experience Victory – Akeneo, accessed December 24, 2025, https://www.akeneo.com/blog/day-12-pxmas-customer-stories/

- Customer Stories | Akeneo, accessed December 24, 2025, https://www.akeneo.com/customer-story/

- PIM Connector Marketplace for App Integrations – Akeneo App Store, accessed December 24, 2025, https://apps.akeneo.com/search?category=syndication&category=print

- Akeneo Activation | Akeneo App Store: PIM Connector Marketplace for App Integrations, accessed December 24, 2025, https://apps.akeneo.com/apps/akeneo-activation

- Product Information Management (PIM) – Pimcore, accessed December 24, 2025, https://pimcore.com/en/products/product-information-management

- Pimcore Recognized as Customers’ Choice in 2024 Gartner® Peer Insights™ – DXP, accessed December 24, 2025, https://pimcore.com/en/resources/blog/pimcore-recognized-as-customers-choice-in-2024-gartner-r-peer-insights-voice-of-the-customer-for-digital-experience-platforms_a495154

- Product Information Management – Pimcore, accessed December 24, 2025, https://pimcore.com/en/products/product-information-management/product-information-management

- PIM and SAP Integration – Pimcore, accessed December 24, 2025, https://pimcore.com/en/resources/insights/pim-sap-integration

- 5 success stories about more efficient product data management thanks to Pimcore, accessed December 24, 2025, https://www.p2media.de/en/newsarticle/5-success-stories-about-more-efficient-product-data-management-thanks-to-pimcore/

- Open Source vs SaaS PIM: Which Product Information Management System Is Right for You? – Catsy, accessed December 24, 2025, https://catsy.com/blog/open-source-vs-saas-pim-which-product-information-management-system-is-right-for-you/

- PIM Software Comparison: The 9 Best PIMs of 2025 – Plytix, accessed December 24, 2025, https://www.plytix.com/blog/best-pim