The B2B Commerce Technology Horizon: Q4 2025 Deep Dive Report

1. The Macro-Strategic Landscape of B2B Commerce in Late 2025

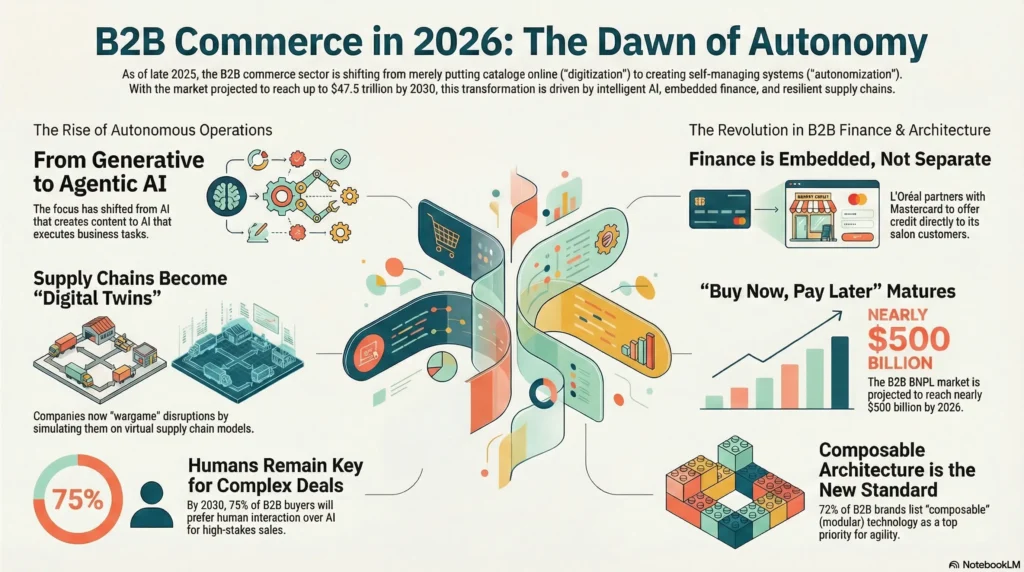

As the global economy approaches the end of 2025, the Business-to-Business (B2B) commerce sector has firmly established itself as the dominant engine of digital trade, eclipsing the growth rates and technological sophistication of its Business-to-Consumer (B2C) counterpart. The fourth quarter of 2025 marks a pivotal transition point: the industry is moving from a phase of “digitization”—where the primary goal was moving catalogs online—to a phase of “autonomization,” characterized by Agentic AI, self-healing supply chains, and embedded financial layers that operate with minimal human intervention.

1.1 Market Magnitude and Growth Trajectory

The sheer scale of the B2B opportunity has forced a realignment of enterprise priorities. Projections circulating in late 2025 indicate that the global B2B e-commerce market is on a trajectory to reach between $36 trillion and $47.5 trillion by 2030.

This expansion is characterized by a “winner-take-most” dynamic in specific verticals, forcing legacy incumbents to adapt rapidly or face obsolescence. The data suggests that B2B e-commerce is growing significantly faster than B2C markets, compelled by a demographic shift in procurement leadership. The “digital native” buyer is now the “digital native” executive, demanding the same friction-free, intuitive experiences in their professional procurement that they experience in their personal consumption.

1.2 The Three Pillars of the 2025 Transformation

Three dominant forces are shaping the technological landscape in Q4 2025, creating a complex interplay of opportunity and risk for market participants:

-

The Agentic Shift: The transition from Generative AI (which creates content) to Agentic AI (which executes tasks) is the defining technological breakthrough of the year. Enterprises are no longer satisfied with AI that can draft an email; they are deploying agents that can negotiate pricing, reallocate inventory, and manage supply chain disruptions autonomously.

3 -

The Consumerization of Finance: The friction of traditional B2B payments—characterized by paper checks, net terms applications, and manual reconciliation—is being dismantled. It is replaced by “vertical fintech” solutions where credit, liquidity, and payment rails are embedded directly into the commerce platform, specific to the industry (e.g., beauty, construction).

5 -

The Supply Chain as a Digital Twin: Volatility has become a permanent feature of the global operating environment. In response, supply chain technology has moved beyond “visibility” (tracking where goods are) to “orchestration” (using AI to proactively reroute goods based on predictive modeling). The widespread adoption of digital twins allows organizations to “wargame” disruption scenarios before they manifest in physical reality.

7

1.3 The “Trust Crisis” and the Human Element

Despite the heavy investment in automation, a counter-narrative has emerged in late 2025: the “Trust Crisis.” As AI agents proliferate, the potential for algorithmic error, hallucination, and ungoverned decision-making has alarmed risk-averse enterprise buyers. Forrester’s predictive analysis for 2026 suggests that B2B companies face a potential loss of over $10 billion in enterprise value due to the ungoverned use of Generative AI.

This tension creates a bifurcated market. For routine, low-complexity transactions, buyers prefer a “rep-free,” self-service experience, with data indicating that self-directed interactions are now more frequent than human ones.

2. The Era of Agentic Commerce: From Chatbots to Autonomous Execution

The defining narrative of Q4 2025 is the operationalization of AI. Throughout 2023 and 2024, businesses experimented with Generative AI for marketing copy and customer service chatbots. In late 2025, these experiments have matured into “Agentic Commerce”—systems where AI agents are granted the agency to perform multi-step workflows, access distinct software tools, and make decisions within pre-defined governance parameters.

2.1 Defining the Agentic Difference

Unlike traditional chatbots that rely on pre-programmed scripts or simple retrieval-augmented generation (RAG), the agents deploying in late 2025 possess “reasoning” capabilities. They can break down high-level goals (e.g., “Source 5,000 units of steel at the best price”) into sub-tasks (search catalogs, compare lead times, negotiate terms, execute purchase orders).

Gartner predicts that while agentic AI is the future, the immediate path is fraught with challenges. They anticipate that over 40% of agentic AI projects initiated in 2025 will be abandoned by 2027 due to escalating costs, unclear business value, and inadequate risk controls.

2.2 Case Study: Lowe’s and the “Pro” Market Revolution

Perhaps the most aggressive adopter of agentic commerce in the retail-industrial sector is Lowe’s. In November 2025, the company unveiled a comprehensive “Total Home Strategy” designed to drive growth through 2026, with agentic AI as a cornerstone.

2.2.1 The “Pro Extended Aisle” Strategy

Lowe’s faces a perennial challenge: the professional contractor (“Pro”) often requires job-lot quantities (e.g., 500 sheets of drywall) that a typical retail store cannot stock. Historically, this forced Pros to go to specialized distributors. Lowe’s response in Q4 2025 is the “Pro Extended Aisle,” powered by agentic AI.

This system allows sales associates—and digital agents—to access inventory not just in the store, but across the entire distribution network and directly from suppliers. The AI agent can instantly query supplier systems for availability, pricing, and job-site delivery windows, creating a seamless quote for the Pro customer.

2.2.2 Financial and Operational Implications

During their Q3 2025 earnings call, Lowe’s leadership explicitly linked their future productivity gains to this agentic deployment.

2.3 Case Study: Home Depot and AI Takeoffs

Parallel to Lowe’s, Home Depot continues to innovate in the construction technology space. In November 2025, reports surfaced regarding Home Depot’s new “AI Takeoffs” tool.

2.3.1 Automating the Blueprint

In construction, a “takeoff” is the process of estimating materials from a blueprint. It is tedious, error-prone, and time-consuming. Home Depot’s tool allows Pros to upload digital blueprints, which the AI then analyzes to generate a complete list of required materials and a cost estimate.

Strategic Insight: This is a move to capture the start of the project lifecycle. By owning the estimation process, Home Depot inserts its SKU list directly into the contractor’s bid. If the contractor wins the job, the order is already built in Home Depot’s system. This represents a shift from “passive retailer” to “active project partner,” powered entirely by AI analysis of unstructured data (blueprints).

2.4 Case Study: SAP Joule and the Autonomous Enterprise

For the broader enterprise market, SAP’s updates in Q4 2025 represent the state-of-the-art in back-office automation. SAP has rebranded its “Joule” copilot into a system of specialized agents embedded within the SAP Business Technology Platform (BTP).

2.4.1 Role-Based Agents

SAP has moved beyond the “generalist” assistant to deploy highly specialized agents trained on specific domain data:

-

Supply Chain Agents: These agents continuously monitor logistics data to detect disruptions. If a shipment is delayed, the agent can autonomously recommend alternative routes or suppliers, contextualizing the risk based on the company’s unique configuration.

14 -

Production Planning Agents: These agents automate the “prerequisite checks” for manufacturing. Before a production order is released, the agent validates material availability, machine capacity, and labor scheduling. This reduces the manual “chasing” that production managers typically perform.

14 -

Change Record Management Agents: In complex engineering environments, managing change orders (e.g., swapping a component in a product design) is a compliance minefield. SAP’s agents assist design engineers by analyzing the downstream impact of change requests and validating data integrity.

14

2.4.2 The “Deep Research” Capability

In a significant update, SAP announced a “Deep Research” capability for Joule, available in December 2025.

2.5 The Amazon vs. Perplexity Fault Line

A fascinating sub-plot in late 2025 is the emerging competition between traditional B2B search (dominated by Amazon) and AI-native search (led by Perplexity and OpenAI).

-

Amazon Business Reshape 2025: At its November conference, Amazon Business doubled down on its own AI tools, launching “Amazon Business Assistant” and “Spend Anomaly Monitoring”.

17 -

The Challenger: However, platforms like Perplexity are launching “agentic shopping tools” (e.g., Perplexity Buy with Pro) that act as a layer above the marketplace.

3

3. Platform Architecture: The Composable and Headless Standard

The “Monolith vs. Headless” debate that characterized the early 2020s has largely resolved by late 2025. For enterprise B2B, “Composable Commerce”—an architecture where best-of-breed components are combined via APIs—has become the default strategic choice.

3.1 The Imperative of Agility

The primary driver for this architectural shift is “agility cost.” In a volatile market, the inability to quickly deploy a new feature (e.g., a new payment method or an AI agent) is an existential risk. Data from Q4 2025 indicates that 72% of B2B brands now list composability as a top tech priority.

3.2 Shopify’s Upmarket March: The “Markets” API

Shopify continues to aggressively challenge legacy B2B platforms (like Salesforce and Adobe) by expanding its enterprise capabilities. The release of the new Shopify Markets API in late 2025 is a critical development for cross-border B2B trade.

3.2.1 Unified B2B and DTC

Shopify’s unique value proposition in 2025 is the “Unified Commerce” model. Most manufacturers act as both B2B suppliers and B2C direct-to-consumer brands. Shopify allows them to run both from a single backend.

-

Company Profiles: The platform now supports complex B2B hierarchies, allowing a seller to map a buyer’s organizational structure (Headquarters vs. Regional Branches) with distinct price lists, payment terms, and tax IDs for each node.

20 -

The Markets API: The new API version (2025-04 preview) allows developers to build highly customized buyer experiences for different regions. This is crucial for B2B, where a buyer in Germany might require a completely different catalog, compliance document set, and payment workflow than a buyer in the US.

19 -

Developer Impact: Shopify is forcing an upgrade cycle, noting that by July 1, 2025, all merchants must migrate to the new Markets infrastructure, signaling a retirement of legacy cross-border tools.

19

3.3 Salesforce Commerce Cloud: The Dreamforce 2025 Pivot

At Dreamforce 2025, Salesforce showcased its response to the composable trend. While maintaining its comprehensive suite, Salesforce is heavily emphasizing “Headless” capabilities and “Agentic” integration.

-

Headless Implementation: Recognizing that large B2B catalogs and disparate pricing models are difficult to manage in a monolith, Salesforce is promoting headless architectures that separate the front-end experience from the back-end transaction engine. This allows B2B brands to build custom “buying portals” in React or Vue.js while relying on Salesforce for the heavy lifting of complex logic.

21 -

Agentforce Marketing: A key announcement at Dreamforce was the integration of AI agents into the marketing stack. These agents can autonomously optimize campaigns and personalize content, closing the loop between B2B marketing intent and commerce execution.

22

3.4 Adobe Commerce: Stability and Security

Adobe Commerce (formerly Magento) remains a stronghold for complex B2B use cases. Its Q4 2025 updates focus heavily on security and platform stability, reflecting its entrenched position in large enterprises.

-

Security Patching: Adobe released multiple security patches (e.g., APSB25-88) in late 2025 to address critical vulnerabilities, highlighting the ongoing maintenance burden of self-hosted or PaaS solutions compared to SaaS.

25 -

PHP Compatibility: The roadmap emphasizes compatibility with PHP 8.2, ensuring that the underlying infrastructure remains modern and secure. This focus on “plumbing” is less flashy than AI but essential for the thousands of B2B distributors running high-volume transactions on Adobe Commerce.

24

4. The Financialization of B2B Trade

One of the most transformative trends in late 2025 is the convergence of fintech and commerce. The “consumerization” of B2B payments is nearly complete, with buyers expecting the same ease of use, instant credit, and digital rewards they receive in their personal lives.

4.1 Vertical Fintech: The Mastercard x L’Oréal Partnership

A standout example of “Vertical Fintech” in Q4 2025 is the collaboration between Mastercard, L’Oréal, and Clara (a Latin American fintech).

-

The Challenge: In the professional beauty industry, thousands of small salons and independent stylists operate in a cash-constrained environment. They lack the credit history to get traditional bank loans for inventory.

-

The Solution: The partnership created the L’Oréal Mastercard BusinessCard. This is not just a credit card; it is a data-driven ecosystem. L’Oréal shares purchasing data with the fintech partner to underwrite credit lines for the salons.

-

The Impact: Salons get working capital to buy more inventory (driving L’Oréal’s sales). They earn rewards (discounts, education) that lock them into the L’Oréal ecosystem. Clara provides the expense management software to help these small businesses digitize their operations.

-

Broader Trend: This signals a move toward “Trade Credit 2.0,” where the supplier (L’Oréal) acts as the anchor for financial services, leveraging their proprietary data to de-risk lending that banks would refuse.

4.2 The Maturation of B2B BNPL (Buy Now, Pay Later)

While consumer BNPL has faced regulatory headwinds and saturation, B2B BNPL is entering a golden age. The market is projected to reach nearly $500 billion by 2026.

-

TreviPay and Net Terms: Companies like TreviPay are differentiating themselves from consumer players (like Klarna) by focusing on the complexity of B2B “net terms.” A B2B transaction involves invoice reconciliation, multiple buyers per account, and cross-border tax compliance. TreviPay’s Q4 2025 messaging highlights that “Pay by Invoice” is the original BNPL, but it is now being digitized and embedded into the checkout flow.

6 -

Regulatory Environment: In the US, Affirm’s CEO has publicly called for caps on late fees, arguing that the industry should rely on better underwriting rather than punitive fees.

29

4.3 Cross-Border Real-Time Payments

The G20 has set ambitious targets for cross-border payments: costs under 1% and settlement within one hour. In late 2025, the industry is making significant progress toward these goals.

-

Mastercard Move: New capabilities launched in late 2025 allow banks to facilitate near real-time B2B cross-border payments without ripping out their legacy SWIFT infrastructure.

32 -

Variable Recurring Payments (VRP): An emerging trend for 2026 is the use of VRPs to replace Direct Debits. VRPs allow for more flexible, authorized pulls of funds between business bank accounts, offering a cheaper and faster alternative to card networks for recurring B2B subscriptions or supply chain payments.

33

5. Supply Chain Transformation: From Visibility to Orchestration

The global supply chain in 2025 remains fraught with volatility—from geopolitical tensions to climate events. However, the technological response has evolved. It is no longer enough to “see” the problem (Visibility); systems must now “solve” the problem (Orchestration).

5.1 The Rise of the AI Control Tower

The “Control Tower”—a central hub for supply chain data—has been upgraded with agentic AI.

-

Maersk’s AI Pivot: Maersk executives confirmed in Q4 2025 that Generative AI is now actively used for capacity planning and pricing optimization. The supply chain is moving from a reactive stance to a predictive one.

34 -

Maine Pointe’s TVO: The launch of the TVO Control Tower in late 2025 exemplifies this trend. It uses AI to ingest data from fragmented sources (logistics providers, suppliers, market indices) to provide a unified view of the supply chain health.

35

5.2 Digital Twins and Resilience Wargaming

McKinsey research released in late 2025 identifies Digital Twins as the key to unlocking supply chain growth.

-

The Mechanism: A digital twin is a virtual replica of the physical supply chain. It allows companies to simulate scenarios: “What if the Port of Los Angeles strikes?” “What if the price of copper doubles?”

-

The Value: By running these simulations, companies can identify single points of failure and pre-plan their responses. This “wargaming” capability is becoming a standard requirement for large B2B contracts, where buyers demand proof of resilience from their suppliers.

6. The Marketplace Revolution: Verticalization and Integration

The B2B marketplace landscape is bifurcating. On one side is the behemoth, Amazon Business, expanding its reach. On the other are highly specialized, vertical marketplaces that offer deep workflow integration.

6.1 Amazon Business: The “Vending Machine” Strategy

Amazon Business is not content with being a website; it wants to be physical infrastructure.

-

Reshape 2025 takeaways: At its annual conference, Amazon signaled a move into industrial vending. By placing Amazon-managed vending machines on factory floors, Amazon captures the “tail spend” (MRO items like gloves, batteries, tools) at the point of consumption.

36 -

Spend Management: Amazon also launched tools for “Spend Anomaly Monitoring,” positioning itself as a partner to the CFO. These tools help finance teams detect non-compliant spending across decentralized organizations, further embedding Amazon into the corporate control structure.

17

6.2 The Vertical Counter-Attack

Specialized marketplaces are thriving by solving problems Amazon cannot.

-

Provi: The alcohol distribution marketplace passed $5 billion in GMV in late 2025.

4 -

DigiKey: In the electronics component space, DigiKey launched an online tool for custom power-supply configuration.

4

Table 1: B2B Marketplace Typology in 2025

| Type | Example | Key Value Proposition | Late 2025 Innovation |

| Horizontal / Generalist | Amazon Business | Selection, Speed, Logistics |

Industrial Vending, Spend Anomaly AI |

| Vertical / Specialized | Provi (Alcohol), DigiKey (Electronics) | Compliance, Technical Config, Workflow |

$5B GMV Milestone, Custom Engineering Tools |

| Ecosystem / Closed Loop | L’Oréal Partner Shop | Credit, Loyalty, Education |

Integration with Mastercard for Working Capital |

| Distributor-Led | Lowe’s Pro | Omnichannel Fulfillment, Job Site Delivery |

“Pro Extended Aisle” Agentic Integration |

7. Investment, M&A, and Capital Flows

The flow of capital in Q3 and Q4 2025 reveals a distinct thesis among investors: The “easy money” for generic B2B e-commerce is gone. The smart money is flowing into the “Intelligence Layer”—analytics, attribution, and specialized infrastructure.

7.1 Venture Capital Trends: The AI Concentration

Global VC funding in Q3 2025 reached $97 billion, a 38% year-over-year increase.

-

The AI Magnet: Over 30% of total capital went to “mega-rounds” (>$500M), primarily for foundational AI companies like Anthropic ($13B raised) and xAI.

38 -

B2B SaaS Focus: In the SaaS layer, funding is targeting companies that make sense of data.

-

Dreamdata: Raised $55 million in Series B funding in October 2025, led by PeakSpan Capital.

39 -

Phocas Software: Secured a majority investment from Accel-KKR in October 2025.

40

-

7.2 M&A Activity: Consolidation and Privatization

The M&A market reflects a maturity in the sector.

-

Sealed Air Take-Private: The $10.3 billion deal to take Sealed Air private is significant.

4 -

Lowe’s acquisition of FBM: By acquiring Foundation Building Materials in October 2025, Lowe’s is vertically integrating its supply chain to better serve the Pro market.

12 -

MSP Consolidation: The Managed Service Provider (MSP) market saw a wave of mergers in Q3 2025 (e.g., Abacus Group, CompassMSP).

41

8. The Human Element and Future of Work

As 2026 approaches, the B2B landscape is not just about technology; it is about the changing nature of work itself.

8.1 The Changing Role of Sales

The rise of self-service portals and AI agents is redefining the B2B sales role.

-

The Death of the Order Taker: Routine reordering is now handled by portals or automated replenishment algorithms. The “order taker” sales rep is obsolete.

-

The Rise of the Consultant: Complex sales still require humans. Gartner’s prediction that 75% of buyers will prefer human interaction for complex deals by 2030

9

8.2 The Trust Crisis

Forrester’s warning of a $10 billion loss due to ungoverned GenAI highlights the new risk frontier.

-

Trust as a Differentiator: In a world flooded with AI-generated content and automated emails, “Trust” becomes a premium asset. Buyers are becoming skeptical of digital interactions that feel generic.

-

The Verification Economy: We can expect a rise in technologies that verify the authenticity of B2B interactions—proving that a quote, a spec sheet, or a compliance document was generated by a verified source and reviewed by a human expert.

8.3 Strategic Outlook: 2026-2030

Looking ahead, the “Agentic” trend will evolve into “Inter-Agent Commerce.” By 2026, Forrester predicts that 20% of B2B sellers will be forced to engage in agent-led quote negotiations.

Imagine a near-future scenario: A buyer’s AI agent (running on Amazon Business) issues an RFP for 10,000 widgets. It automatically contacts the sales agents of three distributors (running on SAP and Salesforce). The agents negotiate price, delivery, and payment terms (via TreviPay) in milliseconds, optimizing for their respective owners’ constraints. The human’s role is simply to set the strategy and approve the final deal.

This is the horizon of B2B commerce technology in late 2025: a world where the infrastructure is headless, the payments are invisible, the supply chain is self-healing, and the negotiation is algorithmic. The winners will be those who build the most intelligent, trusted, and frictionless platforms for this new reality.